Intro to Locked Liquidity

At ElectroSwap, we're pushing the boundaries of what's possible in the world of decentralized finance (DeFi) by introducing an unprecedented feature: the ability for liquidity providers (Liquidity providers) to lock their liquidity tokens for a duration of their choosing. This groundbreaking feature is set to elevate the security, stability, and trustworthiness of the DeFi landscape. This article dives deep into what liquidity locking means, its benefits for the ecosystem, and most importantly, clarifies the implications for our users.

What is Liquidity Locking?

Normally when liquidity providers (Liquidity providers) deposit their tokens into a pool, they own that liquidity and they are normally able to withdraw that liquidity any time they want.

Liquidity locking is a security mechanism that ensures the stability and reliability of liquidity pools within ElectroSwap which promotes a more secure trading environment.

Locked liquidity does not lock tokens that a user buys in any way. Token buyers can freely transfer, buy and sell tokens without any restrictions.

ElectroSwap integrates the option for liquidity providers to demonstrate commitment by locking this liquidity for a predetermined period, preventing the liquidity provider from removing the liquidity until the lock period has ended.

Benefits of Liquidity Locking

Liquidity locking brings numerous advantages to the ElectroSwap ecosystem, including:

- Increased Trust: Demonstrates the liquidity providers' confidence in the pool, building a more trustworthy platform.

- Market Stability: Reduces the likelihood of significant price manipulations by ensuring a stable supply of liquidity.

- Community Confidence: Buyers and traders can engage with the platform, knowing the infrastructure is designed for long-term stability and security.

For Users Buying and Trading

- Freedom: If you're buying or trading tokens from a liquidity pool, rest assured, your tokens are not locked. You have complete freedom to trade, hold, or transfer your tokens at any time.

- Confidence: Trading in pools with a significant portion of locked liquidity means you're participating in a more stable and secure market environment.

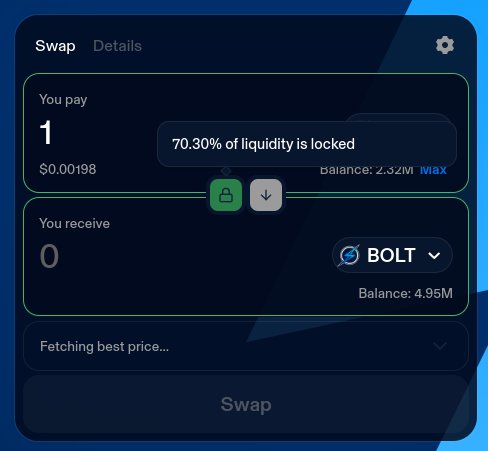

- Transparency: Pools with locked liquidity are clearly marked, allowing you to make informed decisions based on the security and stability of the pool.

For Liquidity Providers

- Commitment: By locking liquidity, you're demonstrating your long-term commitment to the pool's success.

- Security: This feature mitigates the risk of rug pulls, enhancing trust in the ElectroSwap platform.

- Highlighted: The ElectroSwap UI highlights pairs that have locked liquidity, making potential buyers more likely to purchase tokens.

Instructions on how to lock liquidity can be found at the Liquidity Locking Guide

How It Works

- Adding Liquidity: Liquidity providers add their tokens to a liquidity pool, receiving LP tokens (V2) or a position NFT (V3) in return, representing their share.

- Locking Option: Liquidity providers can choose to lock their liquidity, securing their liquidity contribution for a set period. Liquidity Locking guide can be found here

- Trading with Assurance: Traders and buyers engage with the platform as usual, enjoying the enhanced security without any restrictions on their purchased tokens.

Conclusion

Liquidity locking is a testament to ElectroSwap's commitment to creating a secure, stable, and trustworthy trading environment. By ensuring a portion of our pools' liquidity is locked, we aim to foster confidence and encourage long-term participation in our ecosystem.

Stay informed and trade safely as you explore the exciting opportunities ElectroSwap and the DeFi world have to offer.

Join us at ElectroSwap as we set new standards in DeFi, creating a safer, more stable, and trustworthy ecosystem for all. For more information on our features and roadmap, follow us on ElectroSwap's X page and join our Telegram or Discord community to stay updated on the latest developments.